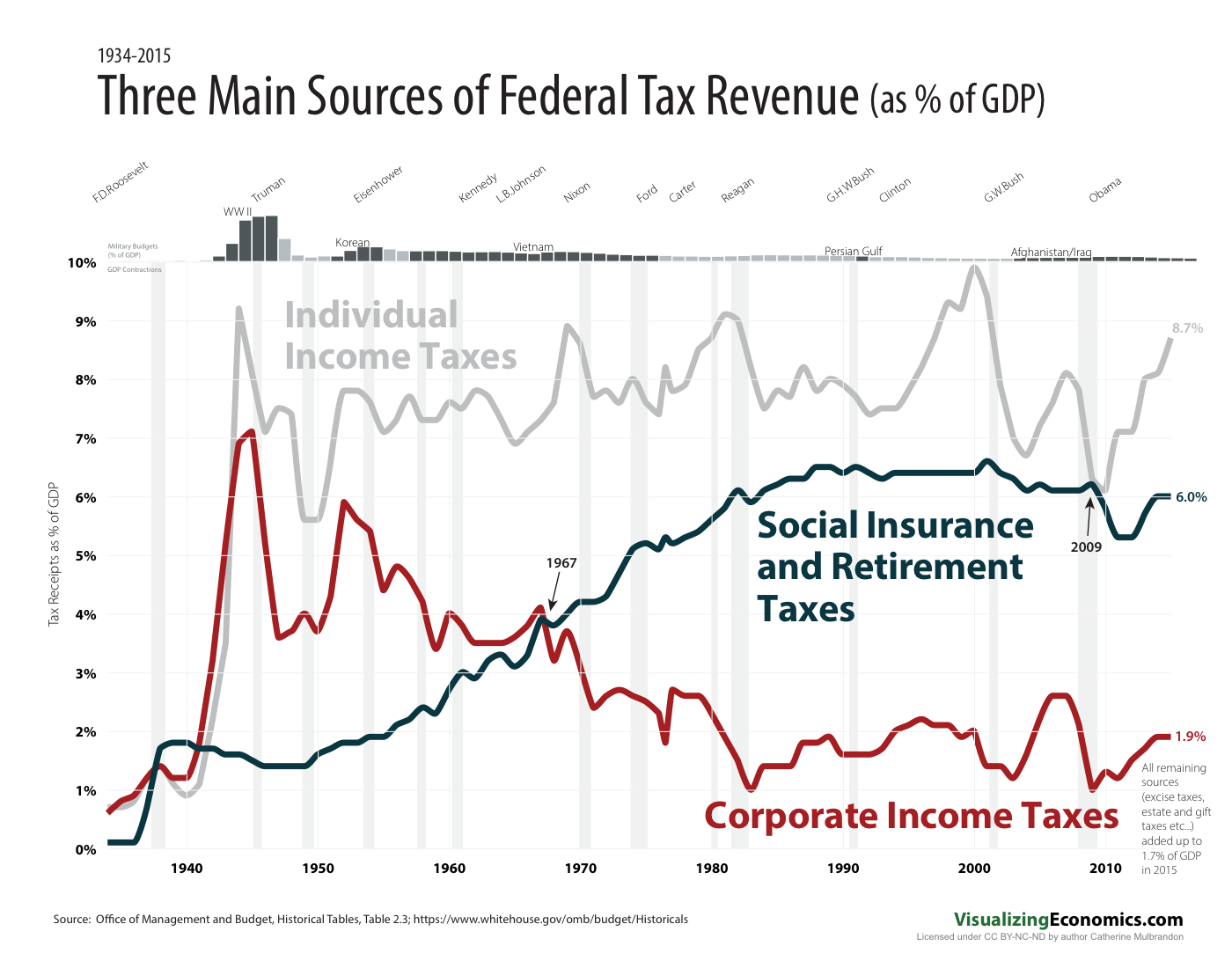

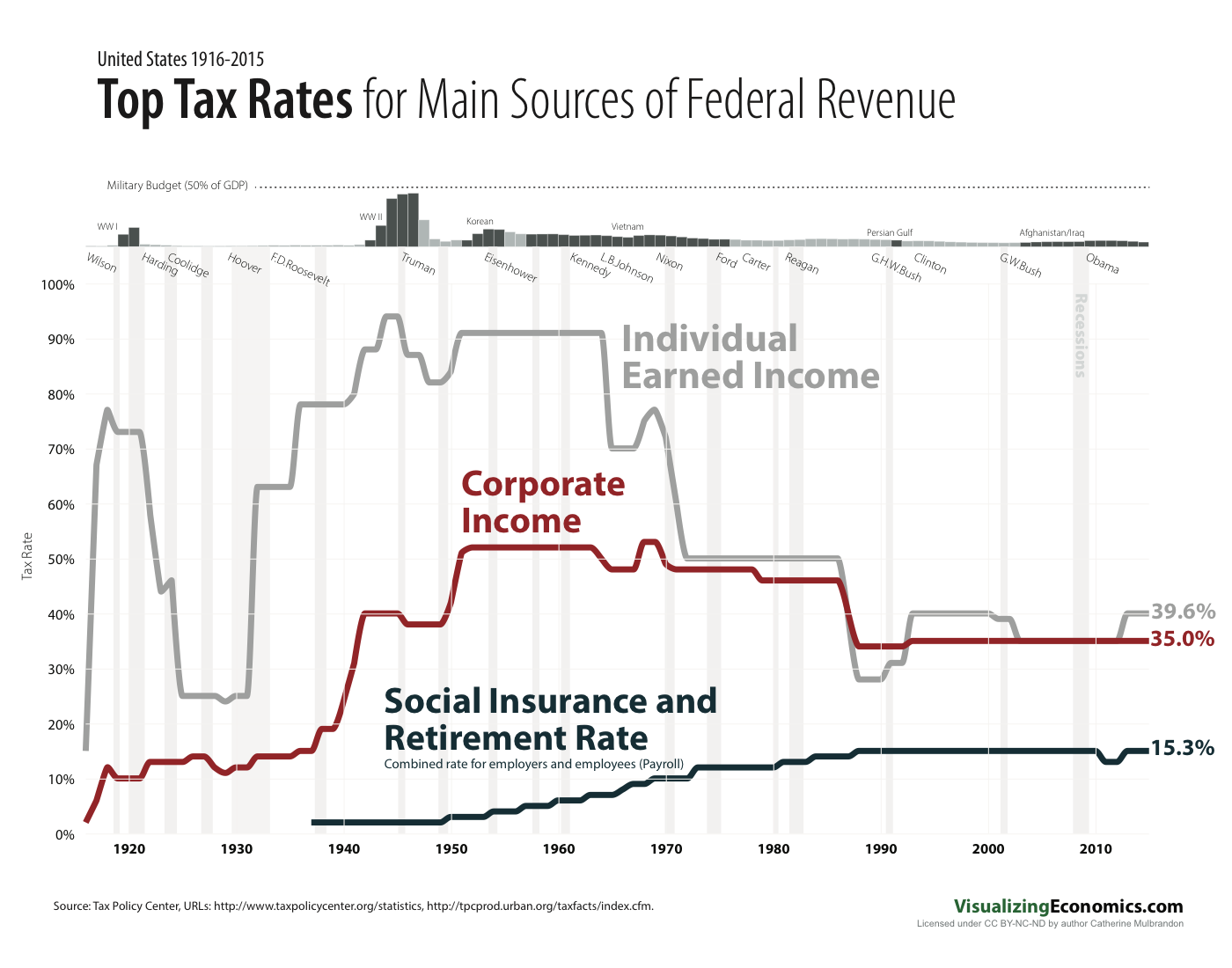

What caught my attention with this Federal revenue dataset was the reversal of the social insurance taxes and the corporate taxes in their relative importance to the Federal government. So what are the tax rates? I revisited my tax poster from a few years ago to make a companion graph about the highest tax rates but that is not the whole story. What is missing is who (and how many) actually paid these top rates. BTW, the individual and corporate rates are the top marginal rate, while the Social Insurance and Retirement tax is capped beyond which you don't pay any additional taxes (it was $118,500 in 2015).

Data from Office of Management and Budget, Historical Tables, Table 2.3, and from Tax Policy Center statistics and their tax fact site.

BTW, if you pledge on Patreon you will get access to high-resolution files and a sneak peek at my work.