I was able to attend the Seminar on Innovative Approaches to Turn Statistics into Knowledge held at the Census Bureau in DC last week. It was an interesting mix of officials from government statistical offices, central banks with academics and designer/data geeks.

Some of the highlights:

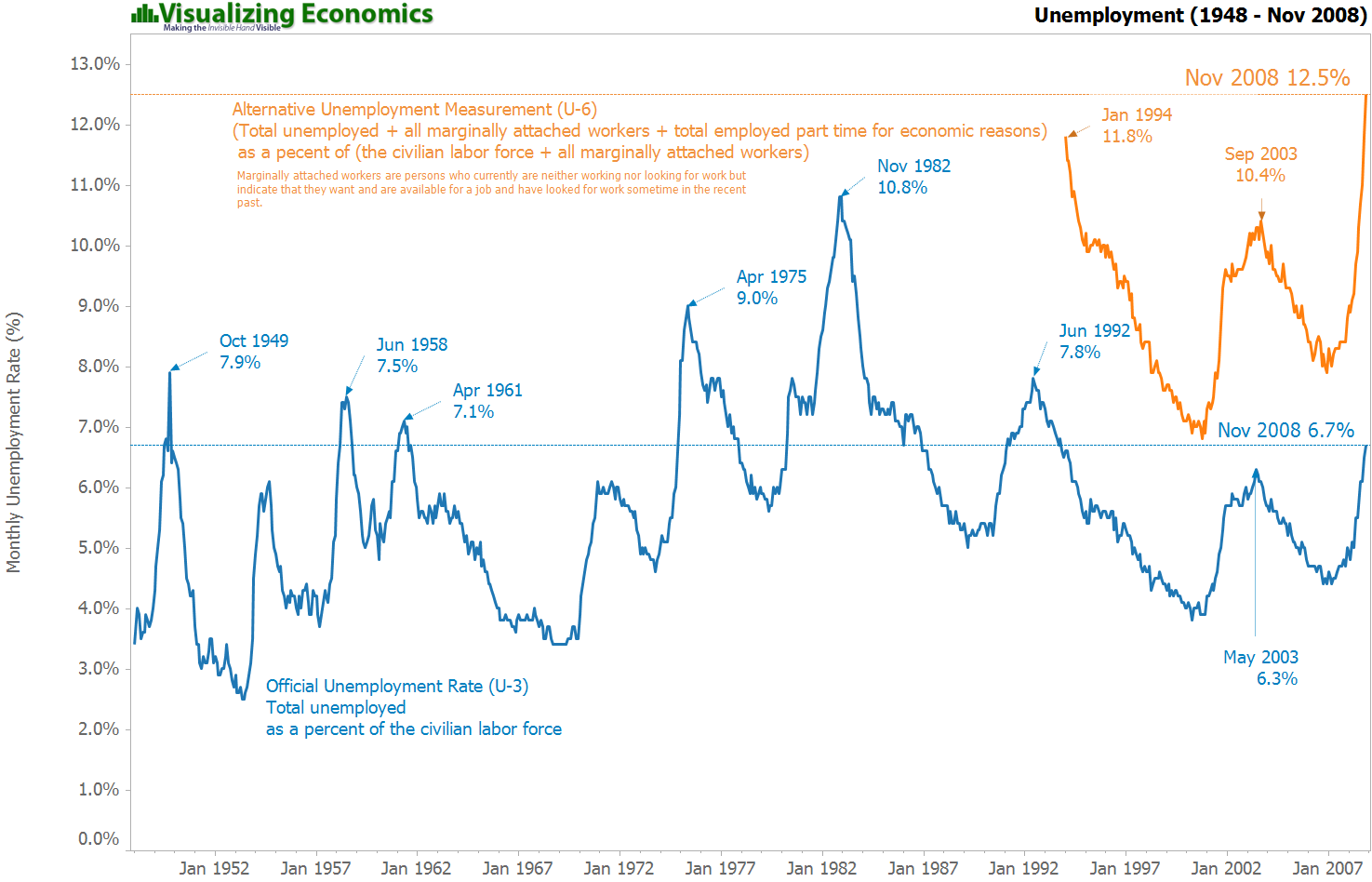

Amanda Cox from the New York Time talking about how she is a like a tour bus driver describing the interesting stuff she finds, That she believes in visualizations that pull something forward while pushing back the rest of the data, have an annotation layer. Also that distributions are more interesting than averages, and when you have something move make sure you know why it is moving. Some of these principals you can see here and here

Helen North from the South Africa's Stats Office talking about the need to build trust in the data as well as to educate people in the uses of their data. This was accomplished by bringing together the delegates from the local municipalities so that they could learn about, discuss and debate with each other the demographic statistics collected about their home districts.

Irene Ros from ManyEyes talking about people uploading their personnel data (Warcraft stats, Facebook friends). She described how hey were using this tool to create "Data Mirrors" i.e. a picture about themselves. Also she mentioned that 88% of Wordle users feel creative when using the tool.

Jim Ridgway from Durham University's Smart Centre talked about students (14-15 year old) when face with a media story and data about the same subject were able to critique the story using the data and in some case spontaneously found more data to include in their critique.

David Spiegelhalter from Cambridge University demonstrated a very interesting site designs used to explain uncertainty to people. He stressed that there was no one right method as different people responded to different methods. During the discussion he brought up an important point to keep in mind when creating visualizations: what is the purpose behind the visualizations? Is it the

- WOW! reaction?

- to increase knowledge?

- or to effect behavior?