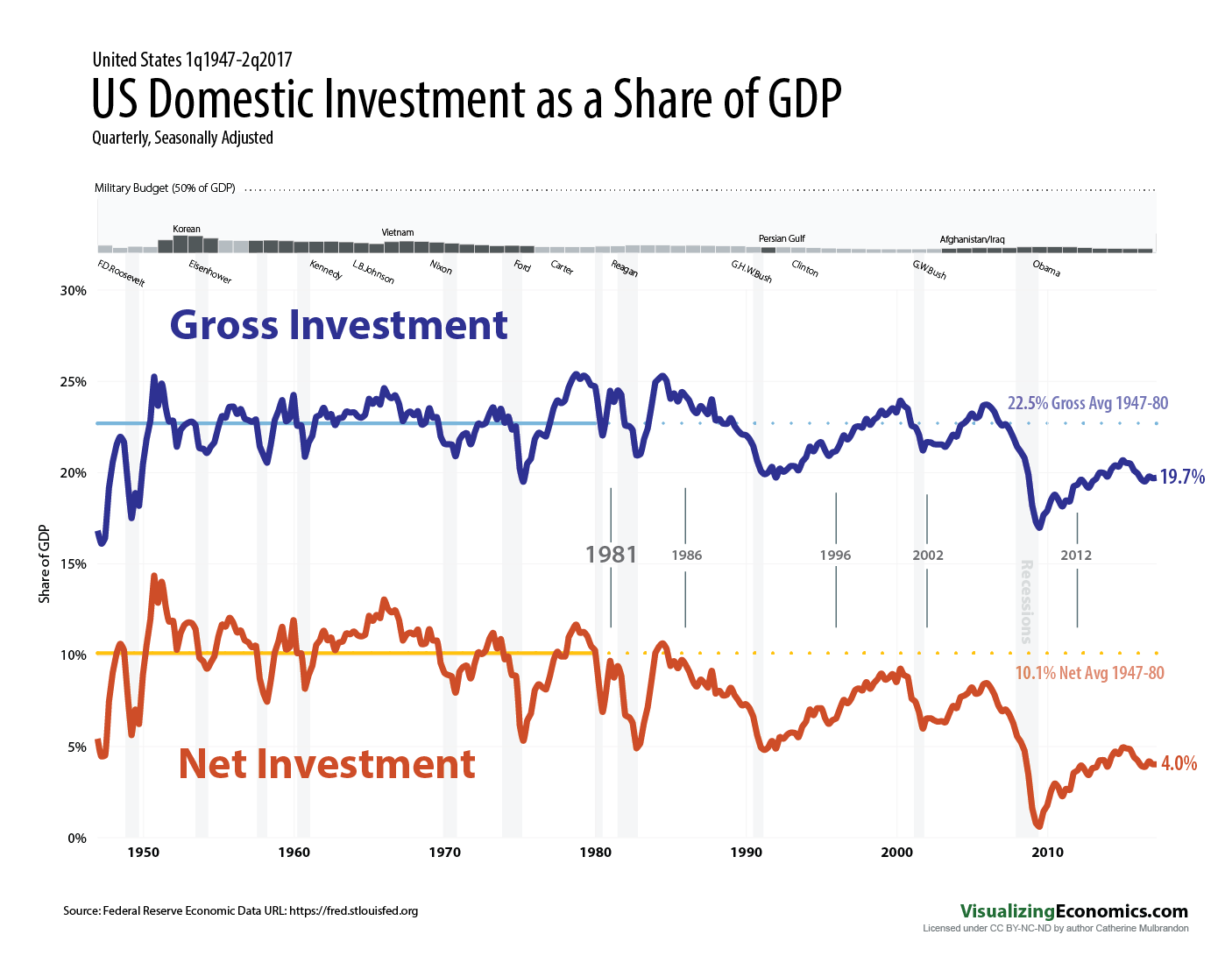

Part 8 of a series about Taxing Businesses

After the 1980s tax reform, the decline in savings and the increase in consumption caused domestic investment to fall, swamping any increase due to incentives from lower taxes on high incomes.

Data source: Federal Reserve Economic Data

The codes used to download data:

W171RC1Q027SBEA Net domestic investment, Billions of Dollars, Quarterly, Seasonally Adjusted Annual Rate

W170RC1Q027SBEA Gross domestic investment, Billions of Dollars, Quarterly, Seasonally Adjusted Annual Rate

Look at the rest of series