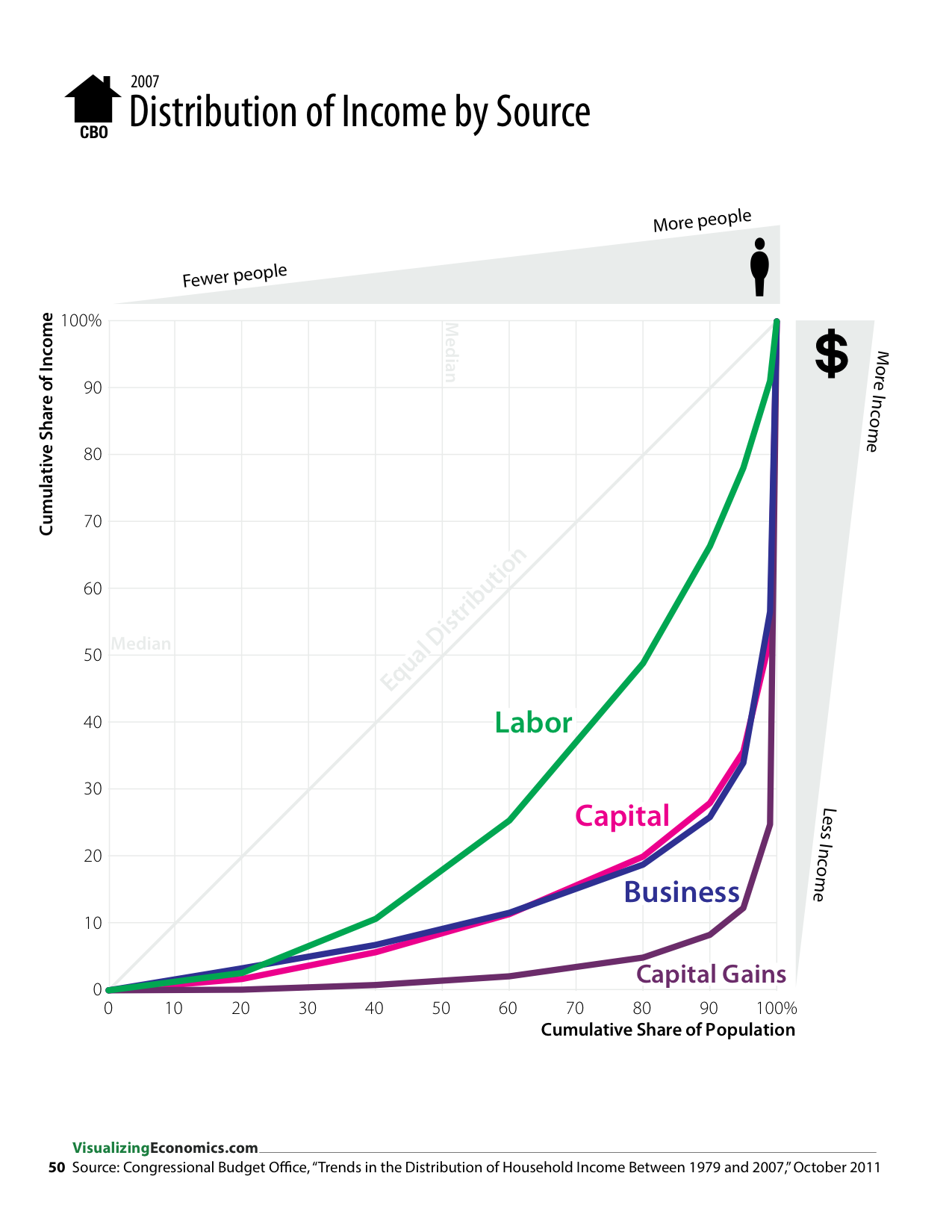

In the graph below, the closer the curve is to the gray, diagonal line the more equal the distribution.

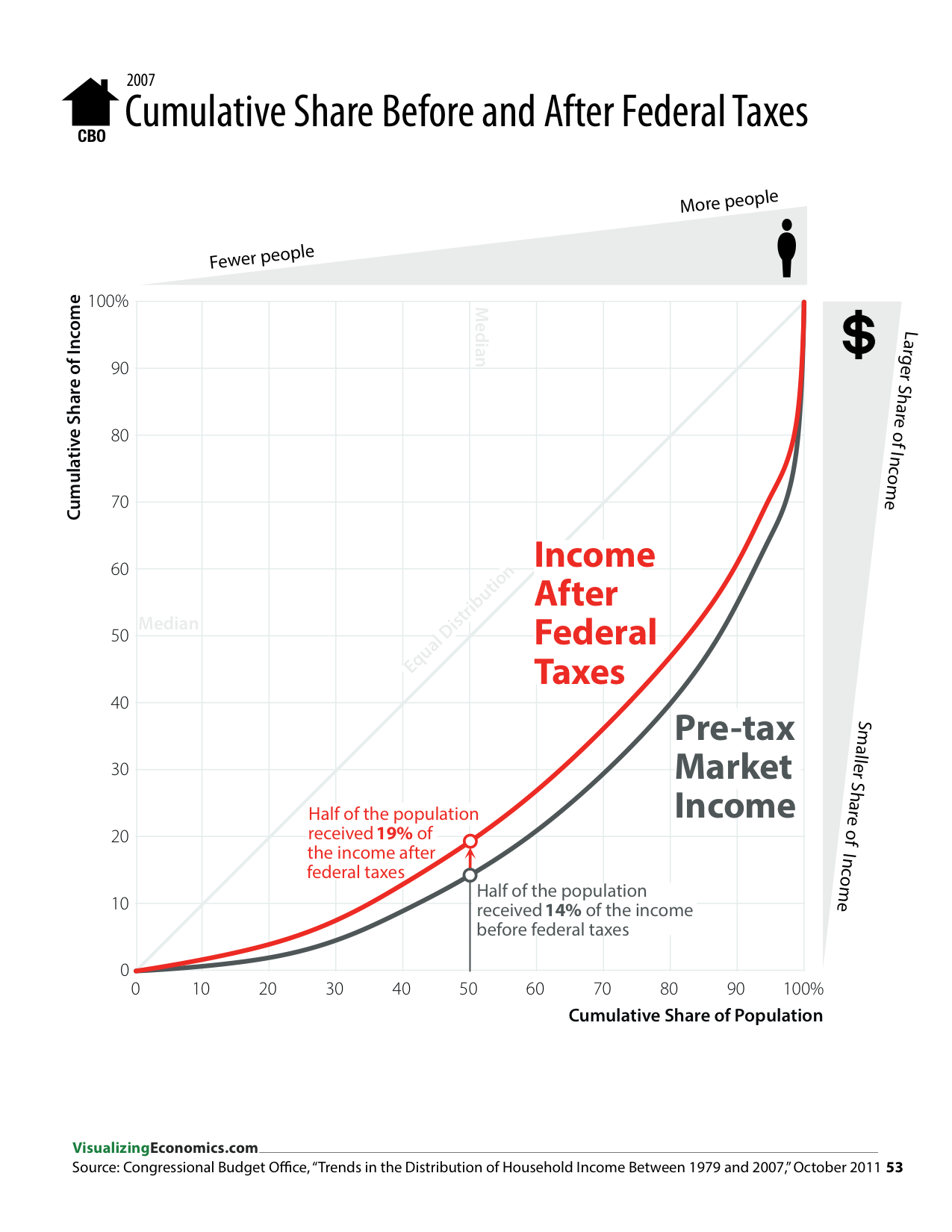

In the next couple of graphics, I focus on the effect on federal taxes on different income groups.

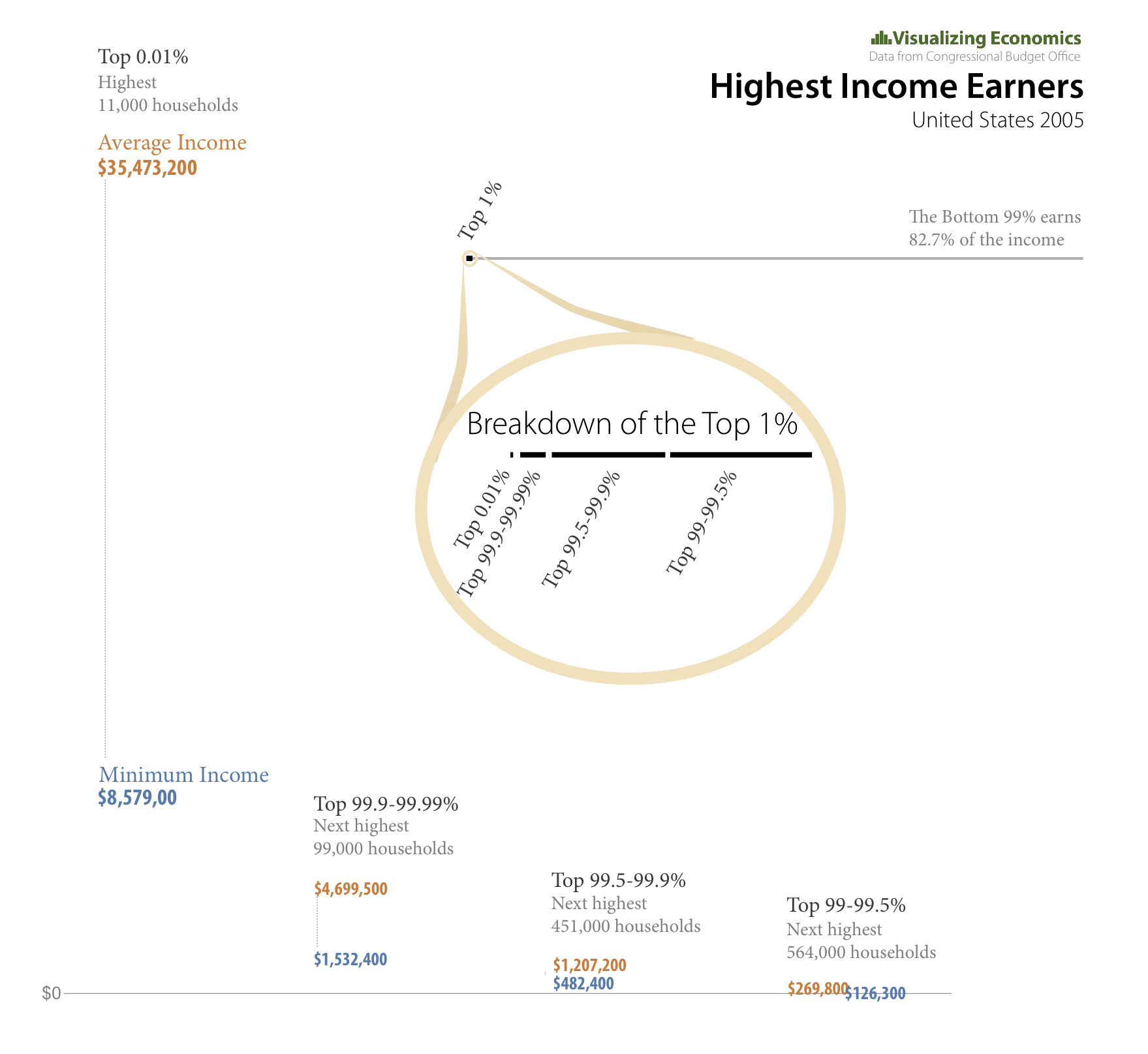

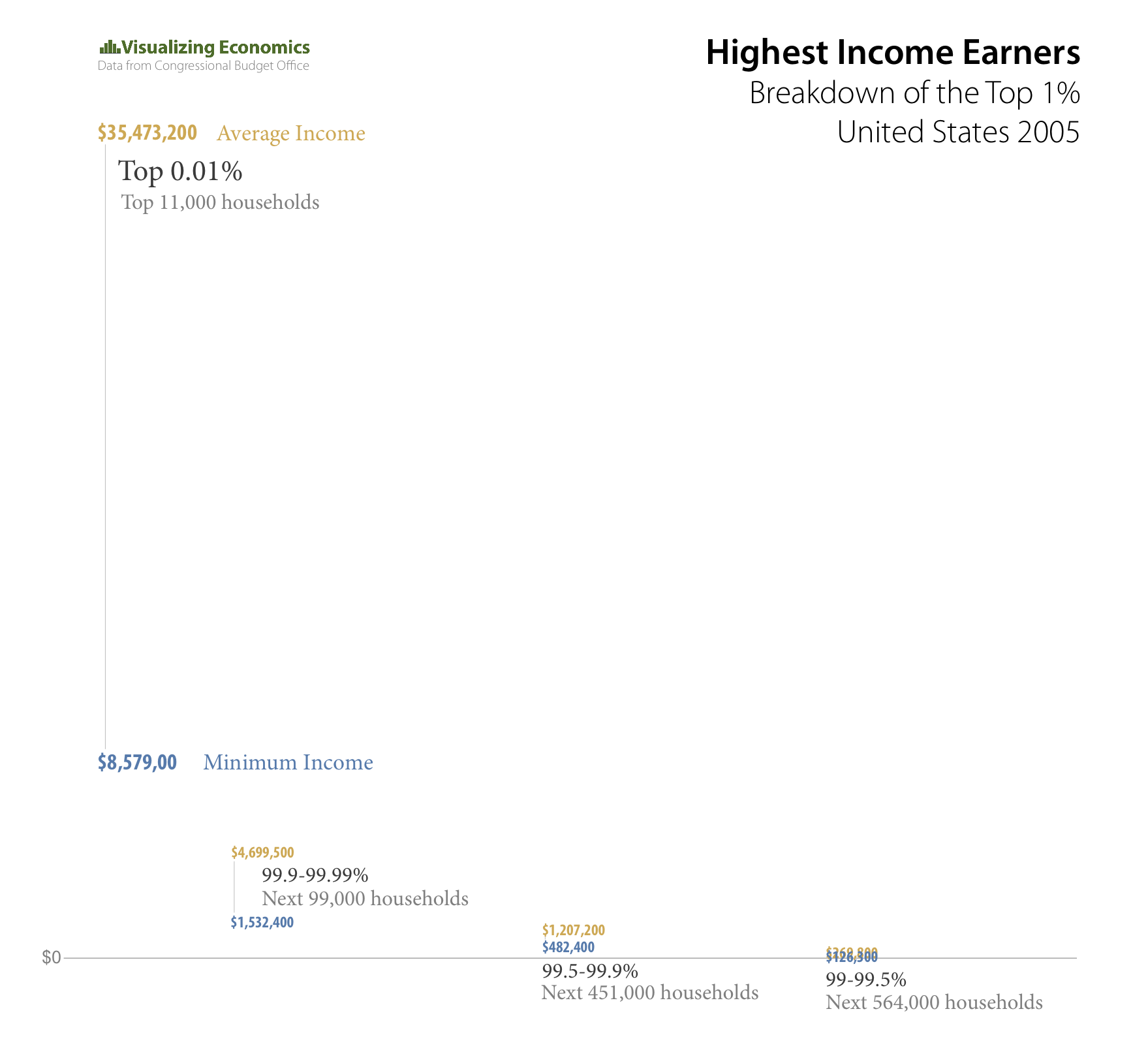

Graphics made in OmniGraphSketcher and Adobe Illustrator. Data from Congressional Budget Office. “Trends in the Distribution of Household Income Between 1979 and 2007.” Summer 2012. http://www.cbo.gov/publication/42729. Congressional Budget Office. “The Distribution of Household Income and Federal Taxes, 2008 and 2009.” August 2012. http://www.cbo.gov/publication/43373.

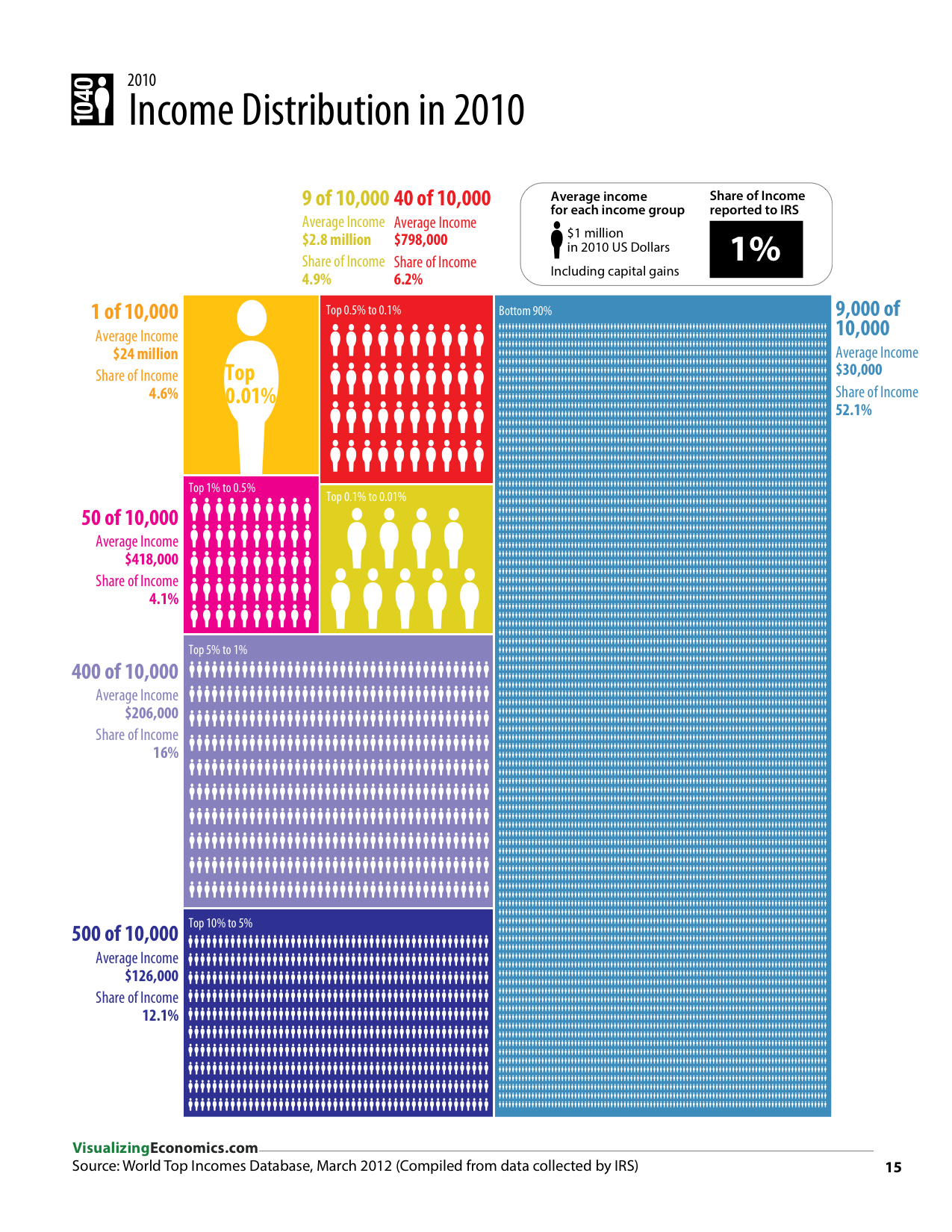

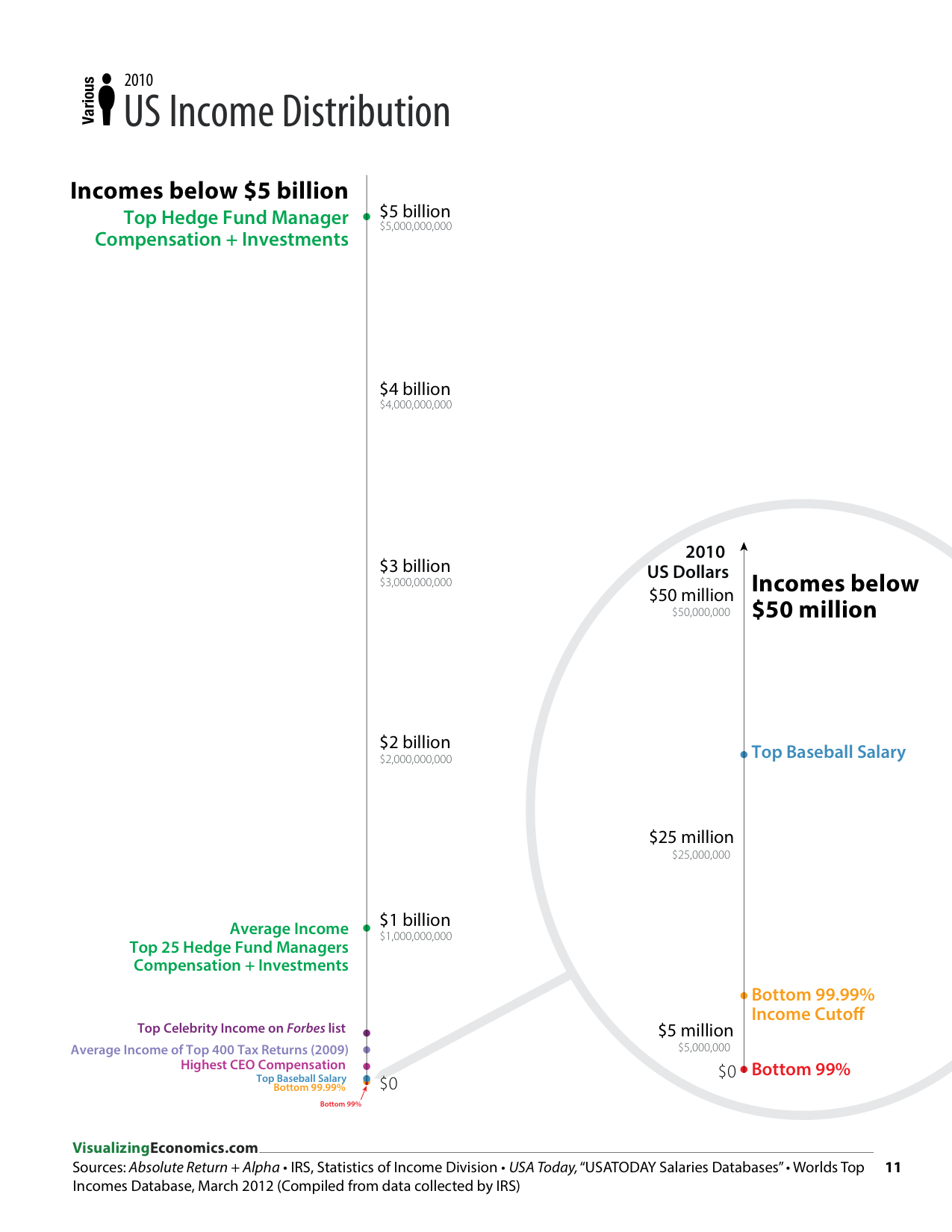

Take a look at more data visualizations from my book, An Illustrated Guide to Income in the United States.